X research source 13 x research source you also may be able to buy a book or use an online trust preparation service either of which typically cost less than 100.

Living trust california do it yourself.

If you hire a lawyer to do the job for you get ready to pay between 1 200 and 2 000.

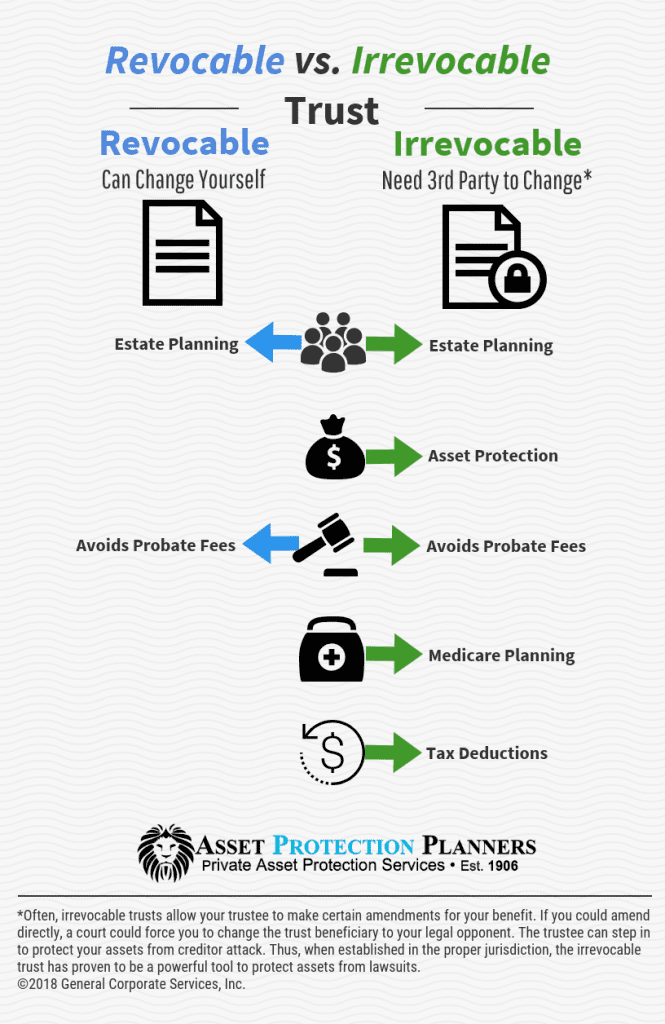

The california revocable living trust is a document that allows a grantor to specify how his her assets and property should be managed during their lifetime and after their death the assets designated to the trust may be managed by the grantor only if the grantor chooses to act as trustee person responsible for maintaining the trust however this option is only available with a revocable trust.

If you do it yourself by buying a book or an online guide it will likely cost less than 100.

The pdf form includes answers to frequently asked questions about wills in california that may help you choose between a free form and other methods.

The challenge of writing a revocable living trust yourself is a formidable one even with the aid of books software and online helps.

California living trusts are created with a trust document.

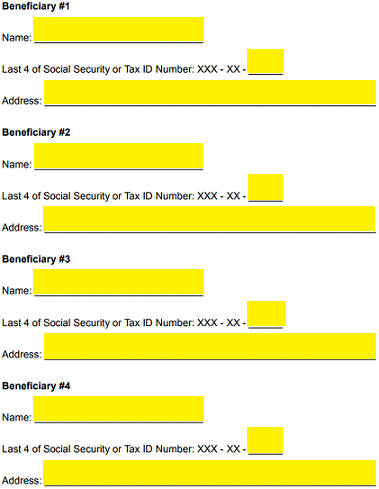

Therefore the person that is selected as the successor trustee will oversee that all the property in the trust will transfer to the beneficiary at the time.

A living trust is an easy way to plan for the management and distribution of your assets and you don t need an attorney to do it.

Although generally you can make a simple living trust by yourself you may need assistance if you have complex or significant assets.

Also known as living or inter vivos trusts their importance is too great to be left to chance.

Note that living trusts do not shield your assets from medicaid laws.

If you hire a lawyer to do the job for you get ready to pay between 1 200 and 2 000.

By brette sember j d.

You must use the free california form as is.

Unlike a will a trust does not go through the probate process with the court.

California does not use the uniform probate code which simplifies the probate process so it may be a good idea for you to make a living trust to avoid california s complex probate process.

The cost of creating a living trust in california depends on which method you use.

A living trust is a document that allows individual s or grantor to place their assets to the benefit of someone else at their death or incapacitation.

How much does it cost to create a living trust in california.

How to create a living trust in california.

Updated september 03 2020 2 min read.

However there are pitfalls to diy estate planning.

In this specific type of trust assets pass from one spouse to another directly avoiding the application of any estate tax on the transfer.

If you are willing to do it yourself it will cost you about 30 for a book or 70 for living trust software.

The california statutory will form is available as a free download from the california state bar association website.

:max_bytes(150000):strip_icc()/GettyImages-522015476-3749ef1cf84449cd9988a0dcbebe17a2.jpg)