In its simplest form a trust is the designation of a person or corporation to act as a trustee to deal with the trust property and administer that property in accordance with the instructions in the trust document.

Living trust forms illinois.

Illinois does not use the uniform probate code which simplifies the probate process so it may be a good idea for you to make a living trust to avoid illinois s complex probate process.

Therefore the person that is selected as the successor trustee will oversee that all the property in the trust will transfer to the beneficiary at the time.

What is a trust.

See information on back panel concerning illinois lawyer finder.

Illinois has a simplified probate process for small estates under 100 000 excluding real estate.

Our free illinois living trust forms are very popular estate planning tools that can be utilized to avoid probate and court supervision of your assets.

In its simplest form a trust is the desig nation of a person or corporation to act as a trustee to deal with the trust property and administer that property in accordance with the instructions in the trust document.

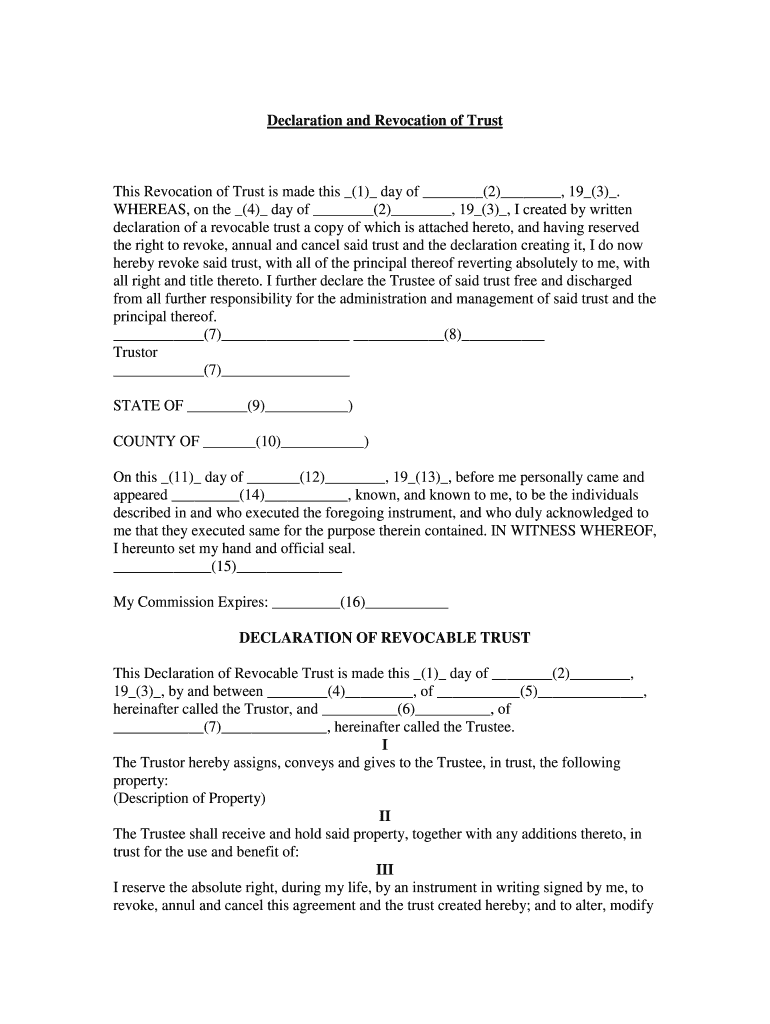

A living trust is a document that allows individual s or grantor to place their assets to the benefit of someone else at their death or incapacitation.

Es and disadvantages of using a living trust as your primary estate planning document.

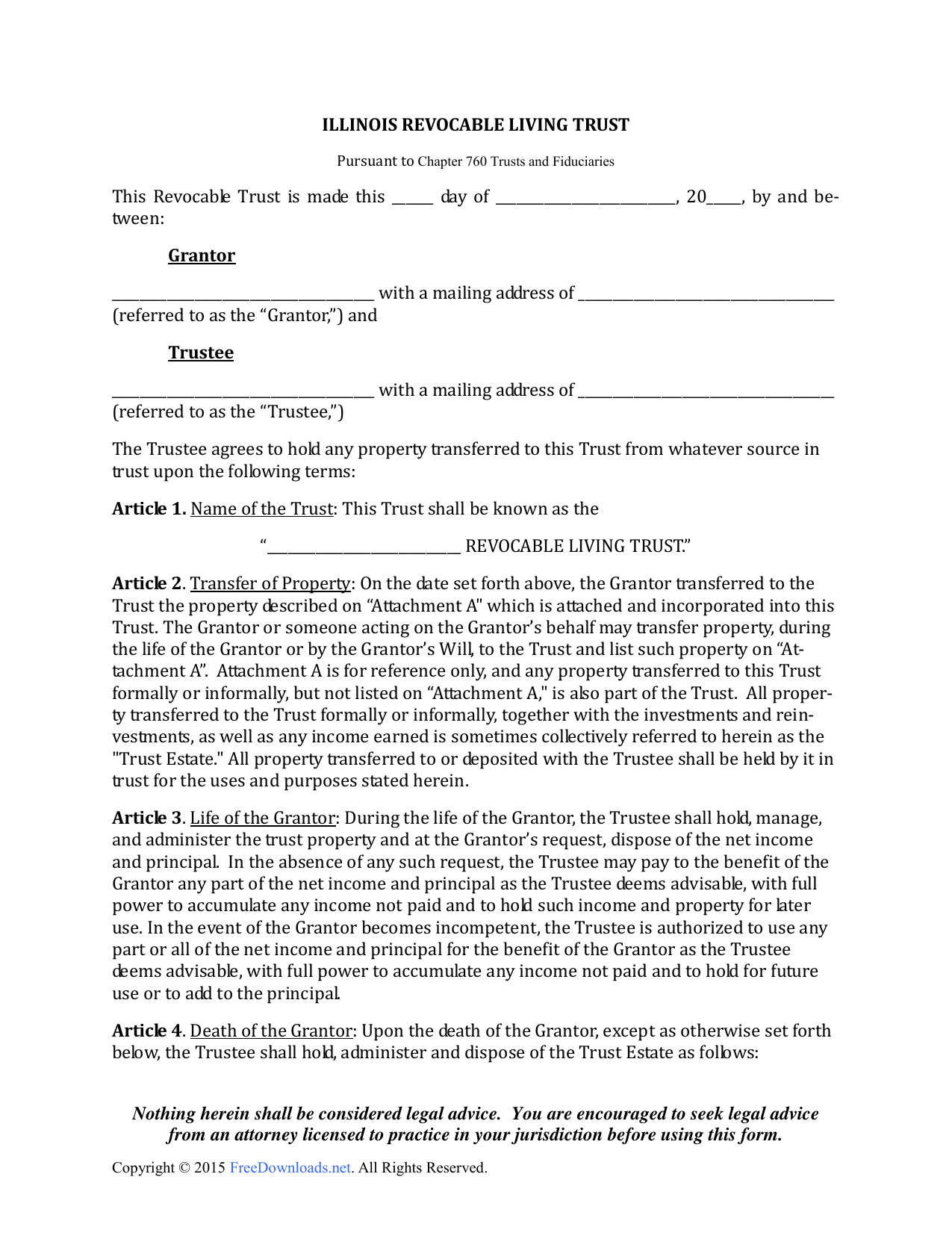

Illinois revocable living trust form the illinois revocable living trust is an entity into which a person places their assets to save the inheritors the long and costly probate process in illinois.

An illinois living trust is a document that allows the recipient s of a deceased individual s assets to avoid the court supervised probate process implemented after a person dies the initial creator of the trust referred to as the grantor will transfer property and assets to the trust and outline specific instructions for what shall be done with said property and assets when they die.

Aside from avoiding probate the grantor person who establishes the trust has continued access to their assets if they become incapacitated in any.

Unlike a will a trust does not go through the probate process with the court.

A revocable living trust is created by an individual the grantor for the purpose of holding their assets and property and in order to dictate how said assets and property will be distributed upon the grantor s death.

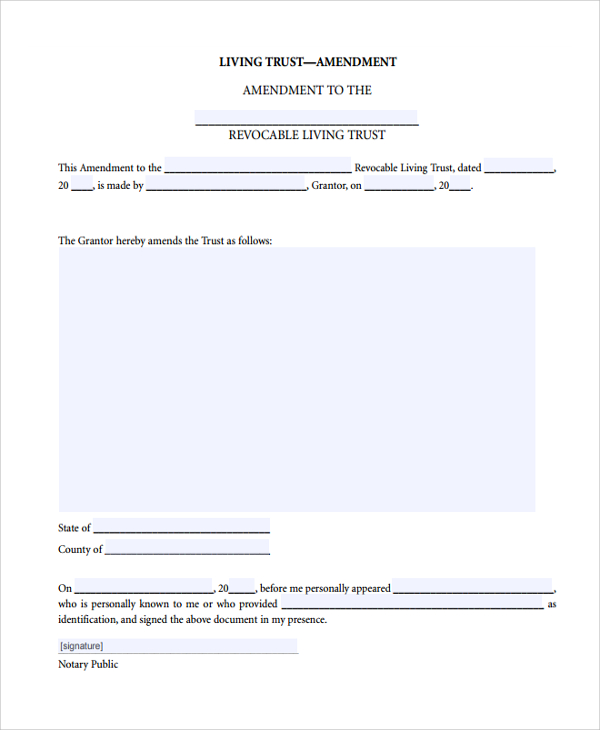

The grantor maintains ownership over their assets and they can make alterations to the document or choose to revoke the trust at any point in their lifetime.

To add real estate to a living trust the grantor s of the trust create a real property deed with the living trust named as grantee.

An illinois living trust form is a legal document that is drafted to transfer a person s assets on to their named beneficiaries upon death.